Singapore, 10th April 2024: Zoth, an ecosystem bridging liquidity across TradFi and OnchainFi, has raised $2.5 million in funding to provide sustainable yields backed by real-world assets (RWAs) and to build a multichain stablecoin-powered RWA ecosystem, bringing native sustainable yield to DeFi.

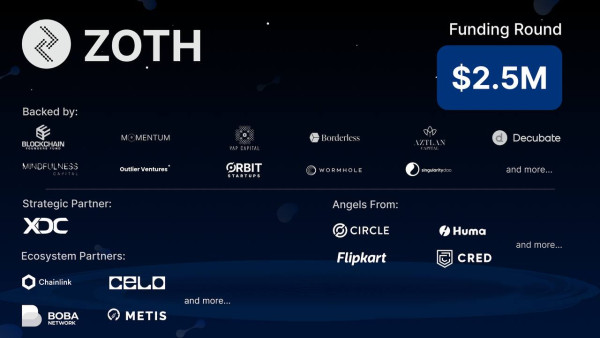

The seed funding round, led by Blockchain Founders Fund, features participation from Borderless Capital, Mindfulness Capital, YAP Capital, Momentum6, Singularity DAO, Aztlan Capital, Outlier Ventures, Decubate, Wormhole Ecosystem Fund, and prominent angels from top crypto-native companies, such as Huma Finance and Circle. This funding comes as the project prepares for a public token offering of $ZOTH.

“At Zoth, we’re building a multi-chain stablecoin-powered RWA ecosystem, harnessing sustainable yield generation on-chain and providing DeFi liquidity. With sustainable yields flowing into DeFi, we’re navigating towards a trillion-dollar opportunity, propelling us towards a $1 billion TVL, backed by RWAs,” said Pritam Dutta, Founder & CEO of Zoth.

“We are proud to support Zoth in reimagining RWA-backed yield generation. Finding stable, risk-adjusted yield is crucial for a healthy stablecoin ecosystem. The business model provides access to capital and an impact on emerging economies worldwide,” commented Mansoor Madhavji, Partner at Blockchain Founders Fund.

Dr Alexander Jais, Founder & Managing Partner of YAP Capital said “We are incredibly excited to announce our support for Zoth as they build one of the leading lending platforms to tackle cross-border trade finance from emerging markets. By enabling third-party credit experts to operate and scale lending businesses on-chain, we believe Zoth is a natural, value-added gateway for institutions to enter the space and foster sustainable growth in the digital asset market as a whole, making it one of the top players in the RWA category with a strong path to profitability.”

The round includes a strategic partnership with the enterprise-ready, RWA-friendly XDC Network blockchain. This strategic alignment is specifically designed to boost the blockchain’s efficiency and transparency in handling real-world assets (RWA), making it an ideal platform for enterprises looking to tokenize real-world assets. Past investors in the project include SOSV (Orbit Startups), Graviton, and prominent angels like Kunal Shah of CRED.

Chen Shanlong, Marketing & Partnerships Lead of XinFin (XDC) Network, added, “We are thrilled to announce our strategic partnership with the Zoth platform, which marks a significant milestone in our mission to harness the power of blockchain technology for the Real World Assets (RWA) space. The XDC Network is committed to providing cutting-edge technology and comprehensive ecosystem support to fuel Zoth’s growth and innovation. Together, we aim to revolutionize the way RWAs are managed, traded, and financed, unlocking unprecedented opportunities for efficiency, transparency, and accessibility. This collaboration is a testament to our shared vision of leveraging blockchain’s transformative potential to empower businesses and individuals alike.”

In less than a year since its inception, Zoth has deployed 6.5 million USD in private credit, originating 50 million USD, and with a total of 140 million USD in the pipeline. This growth is accompanied by the creation of an ecosystem of regulated infrastructure to drive innovative products across its ecosystem. ZOTH-FI, the inaugural product offering is live on Ethereum, Polygon, XDC Network, Metis, Boba, and Celo’s mainnets. Users can earn RWA-backed yields by staking stablecoins in the ZOTH-FI marketplace. The project is gearing up to bring more regulated products like Money Market Funds backed by secure assets such as Treasury Bills, Sovereign Bonds, and Commercial Papers issued by AAA-rated companies.

The funding round follows a year of growth, during which Zoth collaborated with multiple reputed institutional partners such as Chainlink, Wormhole, Celo, XDC, Funfair Ventures, and many more, creating a direct impact and bridging liquidity across TradFi and DeFi. Previously, Zoth has been recognized by Fidelity FCAT, Wormhole Foundation, T-Hub, and has compliant infrastructures in UAE & Luxembourg.

Boston Consulting Group (BCG) suggests tokenization of real-world assets (RWAs) could become a $16 trillion industry by 2030. Secure, sustainable yield coming into DeFi is a multi-trillion-dollar opportunity, and Zoth is on the path to $1 billion TVL, supported by RWAs.

About Zoth

Zoth is an ecosystem that bridges liquidity across TradFi and Onchain Fi — one RWA at a time, effectively expediting the influx of assets and capital between these sectors.

The inaugural offering, Zoth—Fixed Income (Zoth-Fi), is a chain-agnostic institutional-grade platform to provide institutional and accredited investors easy access to secure fixed-income yield assets through stablecoins. Zoth encompasses a diverse spectrum of asset classes including trade finance receivables, T-bills, sovereign bonds, and green finance, permissionless DeFi products.

Learn more about Zoth by visiting:

Website: https://zoth.io/

Zoth Marketplace: https://app.zoth.io/

Telegram Community: https://telegram.me/zothio

Twitter: https://twitter.com/zothdotio

LinkedIn: https://www.linkedin.com/company/zoth-io/

PR Contact: [email protected]

Media Contact

Organization: Zoth Intelligence SG PTE limited

Contact Person: Pritam Dutta

Website: https://zoth.io

Email: Send Email

Country:Singapore

Release id:11003

View source version on King Newswire:

Zoth Raises $2.5 Million in Funding to Provide Sustainable RWA-Backed Yields

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]

Comments