OX Token will help both traders and token holders to create a more dynamic and mutually beneficial ecosystem.

Hong Kong, China — Since its launch in April 2023, the OPNX ecosystem has grown exponentially, both in terms of user and trade volume growth. The crypto world had collectively mocked OPNX, co-founded by the infamous 3 Arrows Capital founders Kyle Davies & Su Zhu, when their first day of trading yielded a grand total of $13.64 in trade volume.

In just a few short months, however, the exchange hit its first major milestone surpassing $100M in 24 hour trade volume. The OX token has also seen a near 10x in value since launch in early June 2023.

People are now paying attention.

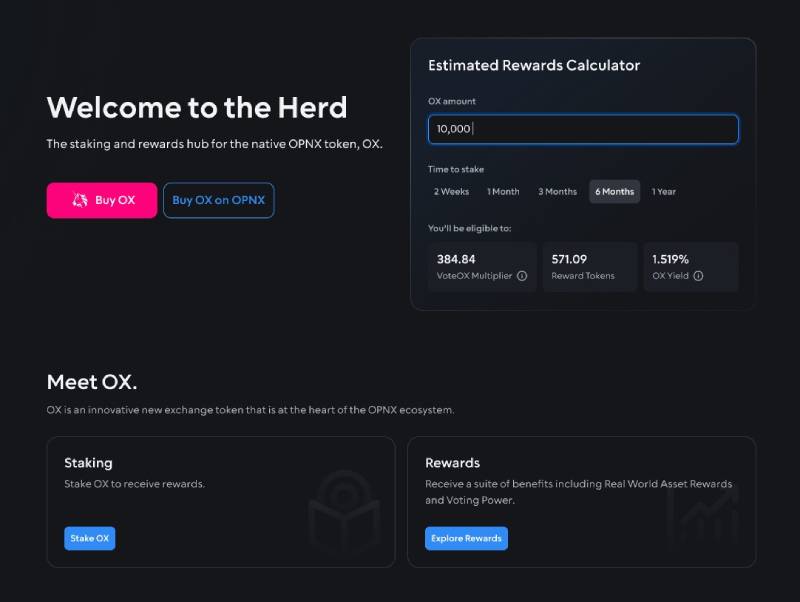

Much of this growth can be attributed to their cult-like marketing campaign, which garnered a devoted following for their exchange’s OX token, collectively referred to as “The Herd” by token holders and stakers.

But the OX token is much more than the memes that meet the eye. It boasts inherent utility and value accrual mechanisms that appeal to both high-frequency traders and DeFi degens alike.

Stake OX to Trade for Free on OPNX

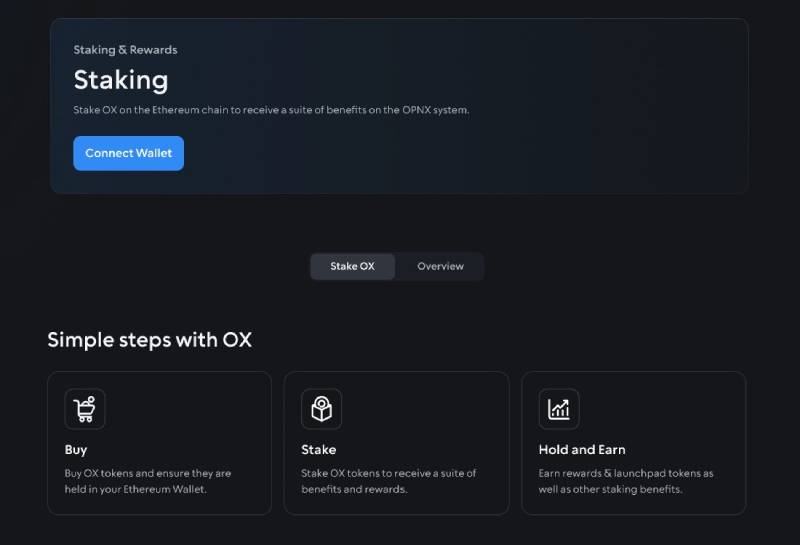

The Herd is the staking and rewards hub for OX stakers. For traders, the value proposition of staking OX is simple: the ability to trade for free on OPNX in perpetuity.

Specifically, traders secure a 100% rebate on trading fees if their staked OX as a percentage of the total staked OX is equal to, or greater than, their trading volume as a percentage of total OPNX trading volume.

For example: If a user has 1% of the total staked OX and their trade volume on OPNX is less than, or equal to, 1% of the total OPNX trade volume, they will receive a 100% trading fee rebate.

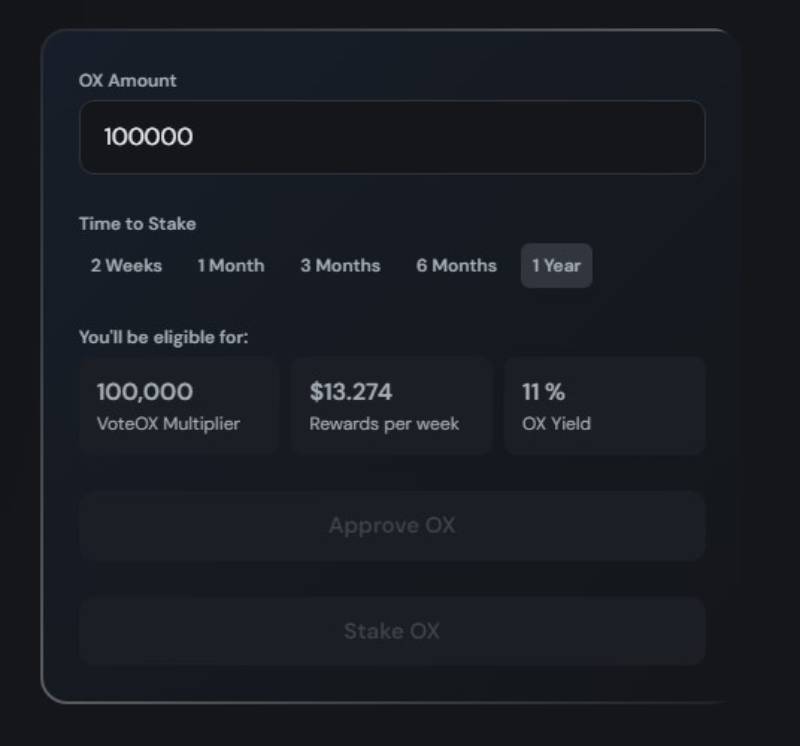

During the first year of launch, stakers benefit from a Bonus Staking Multiplier. This means traders can secure a 100% trading fee rebate on a trading volume percentage equivalent to up to 12 times their current staked OX tokens. These mechanisms encourage high-frequency traders to accumulate and stake OX tokens in order to continually increase their capacity to trade for free.

OPNX Platform Governance for OX Stakers

Traders also benefit from active participation in OPNX platform governance. Taking inspiration from successful DeFi protocols like Curve Finance and their gauge voting system, OX holders can stake their OX tokens for periods ranging from 2 weeks to 1 year. In return, they receive voteOX tokens, which grant them voting rights on crucial exchange parameters, including fee structures, token listings, and other essential mechanisms.

The longer OX holders stake their tokens, the greater their governance power becomes, further building incentive alignment between traders and the OPNX platform, where they’re transformed into partners rather than seen as mere customers.

Stake OX to Earn Yield

Since its launch, OPNX has expanded beyond its initial focus on traders to reach the broader DeFi community with their staking mechanism.

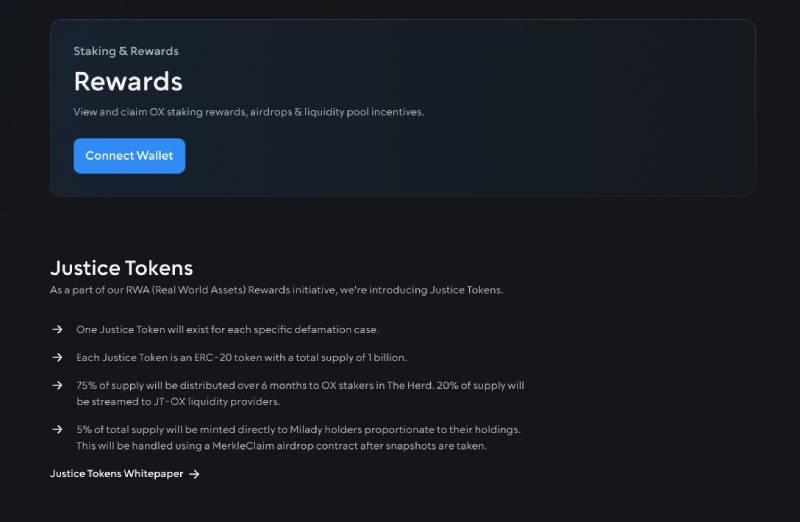

The value proposition remains straightforward: Stake OX tokens and unlock opportunities to earn yield in the form of Real World Assets (RWAs) and Launchpad tokens.

How is OPNX different from other exchanges? OPNX is focused on tokenizing RWAs and making them tradable on exchange order books. The introduction of tokenized FTX and Celsius bankruptcy claims has already gained interest and traction among a portion of the millions of users who have their liquidity locked up in long arduous bankruptcy proceedings.

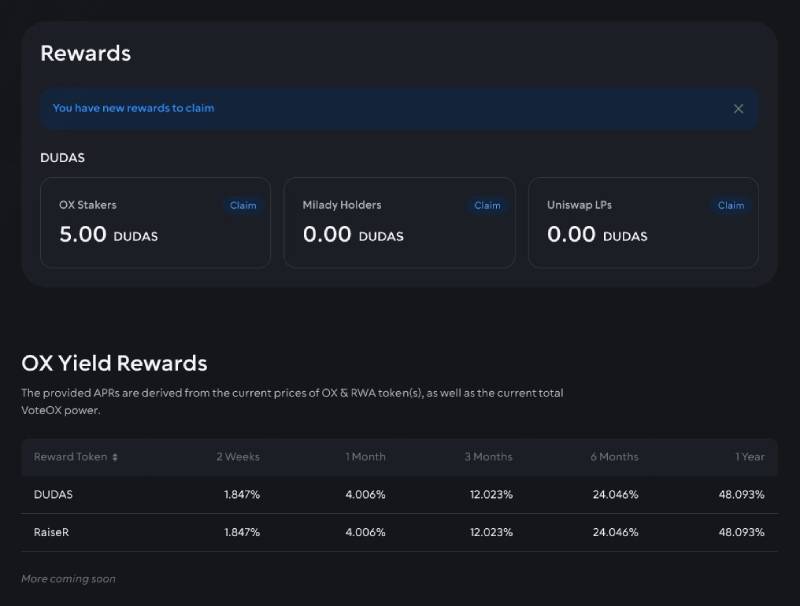

OPNX simultaneously launched Justice Tokens (JTs), which they describe as “independent meme tokens with no intrinsic value, no backing and no expectation of return”. However, JTs are tokenized representations of real-life defamation cases, with some speculating that any potential settlement outcomes may be distributed between token holders. The first of these, DUDAS, representative of a defamation case brought by OPNX against venture capitalist Mike Dudas, is already being airdropped weekly to OX stakers, with a second potential JT announced recently relating to the so-called “cryptocurrency researcher” FatManTerra.

OPNX Launchpad

OPNX recently announced their ecosystem partner 3AC Ventures and Launchpad initiative, which has already lined up two exciting projects. First announced was RaiseR, an innovative platform for permissionless credit issuance and secondary market liquidity, with 10% of the RZR tokens to be airdropped to OX stakers.

Last month, OPNX announced a high-profile collaboration with Gameplan, UFC legend Khabib Nurmagomedov’s new sports metaverse venture, which will also see OX stakers receive a portion of GPLAN tokens.

This continues a pattern of 3AC Ventures investing in projects and giving a portion of the tokens freely to the OX stakers in the Herd as a gesture of goodwill to the OX community.

Staked OX as Collateral

Typically, users face a dilemma between staking tokens for yield or holding liquid tokens for trading and collateral purposes. Drawing inspiration once again from popular DeFi trends, particularly liquid staking, OPNX will allow users to have the best of both worlds by incorporating staked OX as collateral for their portfolio margin product. This means, users will be able to use staked OX to trade perpetual contracts on OPNX while also reaping yield in the form of RWAs and launchpad tokens. OPNX aims to convert yield hunters into active traders on the platform.

Nearly 70% of all OX in existence is currently staked by Herd members with traders and DeFi degens poised to unlock a suite of rewards from the OPNX ecosystem.

Be part of the Herd and join OPNX today.

Media Contact

Company Name: OPNX

Contact: Leslie Lamb

Contact Email: [email protected]

Website: Opnx.com

Comments