Using a long-term average gold price of US$2,640, the Net Present Value (NPV) of WRLG is estimated at $496 million. The re-rate from developer to producer typically takes a company from 0.5X NAV to 1x NAV.

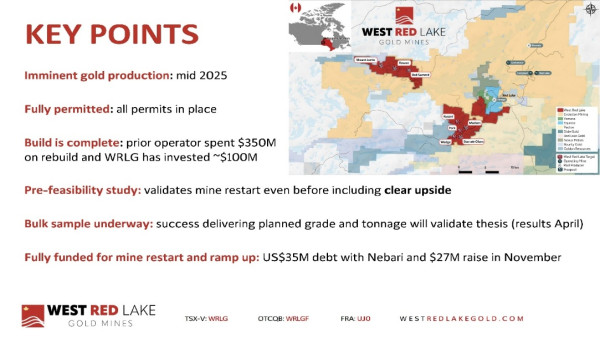

Canada, 27th Feb 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On February 18, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) announced the filing of its independent pre-feasibility study (PFS) prepared by SRK Consulting.

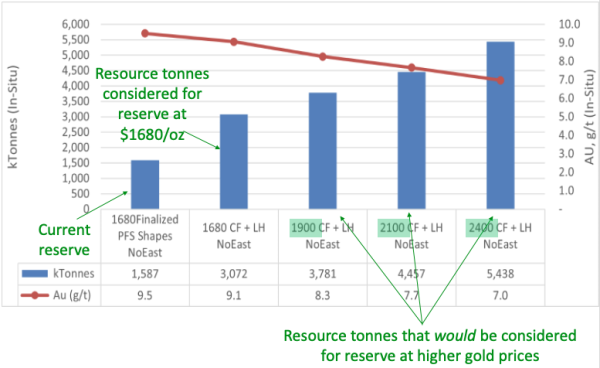

The reserve cut-off price that was used in the PFS was US$1,680 per oz.

“Investors are surprised how conservative that number is,” Gwen Preston, VP of Communications told Guy Bennett, CEO of Global Stocks News (GSN). “But there’s a simple explanation.”

“SRK has internal guidelines for a PFS,” Preston continued. “The reserve cut-off price would be higher for a full Feasibility Study. The fact that we are going directly from PFS to production does not change SRK’s guidelines.”

Buried in the “Other Relevant Data” section of the 395-page technical report and noted in the Executive Summary, is a chart that shows how the reserve count could potentially change at gold prices closer to the current price of US$2,900.

The SRK chart below reveals what tonnes from the resource would have made it into consideration for inclusion in the reserve at higher reserve gold price cut offs.

The first blue column is the WRLG reserve as stated in the PFS, at the US$1680 cutoff price. This reserve was drawn from the second blue column, which shows the tonnes of the resource that were considered for inclusion in reserve.

Access development and other cost factors were then applied to reach the reserve base shown in the first column. That’s why columns one and two have US$1,680 in the label, but different totals.

One takeaway is that access development is very important at Madsen. It was the force that reduced potential reserve tonnes by half to get the actual reserve.

The other takeaway is that increasing the reserve cut off price to US$2,400 boosts the resource tonnes considered for reserve inclusion by almost 77% (3,072 to 5,438 tonnes).

“The undiluted grade falls from 9.1 grams/tonne to 7.0 grams/tonne but there’s a big tonnage increase,” Preston told GSN. “At the current gold price, the reserves should be significantly higher.”

On February 25, 2025 WRLG announced that it closed the public offering of 23,628,000 charity flow-through units at a price of C$0.8487 raising just over $20 million.

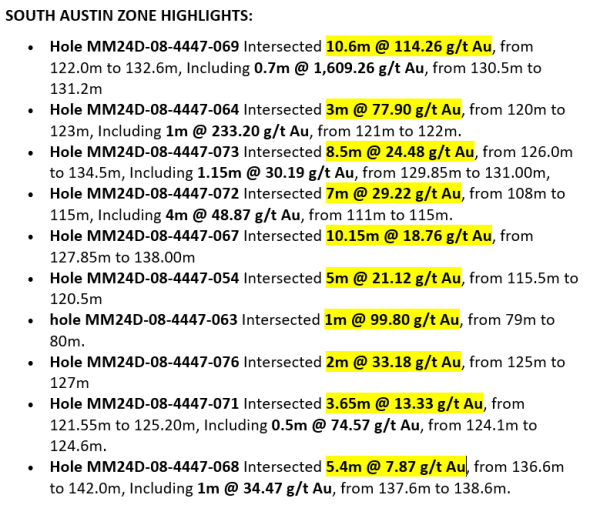

On February 26, 2025 WRLG reported definition drill results from the high-grade South Austin Zone.

Mine re-start update:

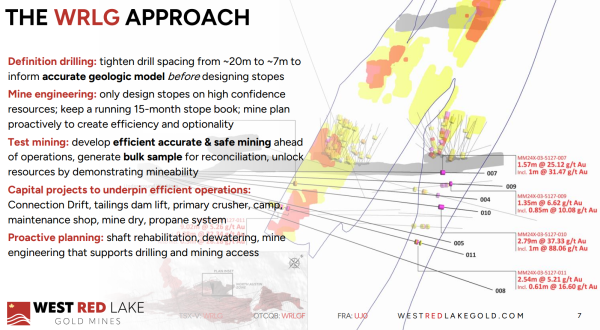

Bulk Sample Program: plans to mine at least 10,000 tonnes of material from six stopes. WRLG prioritized parts of the Madsen resource for extraction early in the mine life based on grade, tonnage, and ease of access.

Mill Startup for Bulk Sample Processing: after 28 months of maintained dry shutdown, the mill is scheduled to restart imminently. First feed will be 3,000 tonnes of legacy low-grade material to pack out the grinding mills. All operational readiness milestones have been met for the process plant.

The Connection Drift: it is now 80% complete, allowing WRLG to move all material on large haul trucks through the East Portal, which is situated close to the crusher and the mill.

Underground Development: from August 2024 to January 2025 the pace of new underground development increased notably, with average daily meterage rising 23% each month.

Camp and Mine Dry Installations: final construction permits for the Madsen Mine camp received from the Municipality of Red Lake on January 31st. Final installation work is now underway, which is primarily power, water, sewer, and propane connections.

The Gold Sensitivity Price chart buried in the technical report indicates the amount of meat that SRK potentially left on the bone @US$1,680 reserve cut off price.

Using a long-term average gold price of US$2,640, the Net Present Value (NPV) of WRLG is estimated at $496 million. The re-rate from developer to producer typically takes a company from 0.5X NAV to 1x NAV.

WRLG’s current market cap is $214 million.

“West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025,” Preston told GSN. “One is Artemis, which has arguably already been re-rated. Then there is Erdene in Mongolia, Robex in Guinea, and West Red Lake Gold in Ontario, Canada.”

“When investors rotate into gold, they look for large producers, growing producers, and new producers,” added Preston. “We are a strong candidate in the third category, operating in a Tier 1 Mining jurisdiction.”

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: [email protected]

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

- “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

- The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

- The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca.

Media Contact

Organization: Global Stocks News

Contact Person: [email protected]

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:24436

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]

Comments