Navigating the complex world of family office investments can be a daunting task for even the most seasoned financial professionals. As the wealth management landscape continues to evolve, family offices are increasingly seeking innovative and sophisticated strategies to preserve and grow their assets.

Understanding the unique nature of family office investments

Family offices are distinct from traditional investment firms in several key ways. They typically manage the wealth of a single family or a small group of families, allowing for a more personalized and long-term approach to investment management. This unique structure enables family offices to focus on preserving wealth across generations while also seeking opportunities for growth and diversification.

One of the primary challenges faced by family offices is balancing the need for capital preservation with the desire for wealth accumulation. This delicate balance requires a nuanced approach to risk management and asset allocation. Family offices must consider not only financial goals but also the family’s values, legacy, and philanthropic objectives when crafting their investment strategies.

Key components of a successful family office investment strategy

A well-designed family office investment strategy encompasses several critical elements. First and foremost is the establishment of clear investment objectives that align with the family’s overall goals and values. These objectives should be specific, measurable, and time-bound, providing a framework for decision-making and performance evaluation.

Asset allocation plays a crucial role in family office investment strategies. A diversified portfolio that spans multiple asset classes, geographies, and investment vehicles can help mitigate risk and capitalize on various market opportunities. Family offices often employ a mix of traditional investments, such as stocks and bonds, alongside alternative assets like private equity, real estate, and hedge funds.

Risk management is another vital component of family office investment strategies. This involves not only assessing and mitigating financial risks but also considering reputational, legal, and operational risks that may impact the family’s wealth. Implementing robust risk management processes and systems can help protect the family’s assets and ensure long-term financial stability.

Emerging trends in family office investment strategies

As the investment landscape continues to evolve, family offices are adapting their strategies to capitalize on new opportunities and address emerging challenges. One notable trend is the increasing focus on sustainable and impact investing. Many family offices are incorporating environmental, social, and governance (ESG) factors into their investment decision-making processes, aligning their portfolios with their values and long-term sustainability goals.

Another emerging trend is the growing interest in direct investments and co-investments. Family offices are increasingly seeking opportunities to invest directly in private companies or real estate projects, either independently or alongside other investors. This approach can provide greater control over investments and potentially higher returns, albeit with increased complexity and risk.

Technology is also playing an increasingly important role in family office investment strategies. From advanced analytics and artificial intelligence to blockchain and digital assets, family offices are leveraging cutting-edge technologies to enhance their investment processes, improve risk management, and identify new opportunities.

Tailoring investment strategies to family dynamics

One of the unique challenges faced by family offices is the need to balance the diverse interests and priorities of multiple family members across generations. Successful family office investment strategies often incorporate governance structures and decision-making processes that promote transparency, communication, and alignment among family members.

Education and succession planning are critical components of this process. Many family offices invest in financial education programs for younger generations, helping to build their investment knowledge and prepare them for future roles in managing the family’s wealth. Succession planning ensures a smooth transition of wealth and decision-making authority across generations, preserving the family’s legacy and investment strategy.

Performance measurement and evaluation

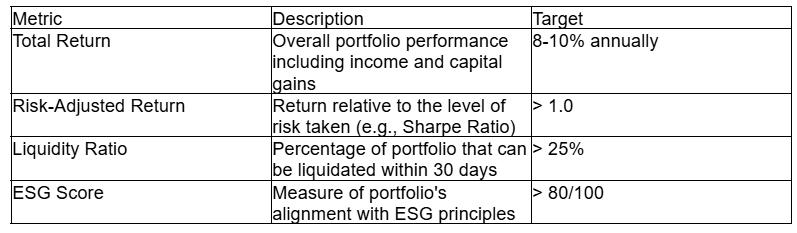

Effective family office investment strategies require robust performance measurement and evaluation processes. This involves setting appropriate benchmarks, tracking key performance indicators, and regularly reviewing and adjusting the investment strategy as needed. Family offices often employ sophisticated reporting and analytics tools to provide real-time insights into portfolio performance and risk exposure.

Here’s a sample table showcasing key performance metrics for a family office investment strategy:

Navigating challenges and opportunities in family office investing

Family offices face a unique set of challenges and opportunities in today’s investment landscape. One of the primary challenges is the low-yield environment, which has made it increasingly difficult to generate consistent returns through traditional fixed-income investments. This has led many family offices to explore alternative investment strategies and asset classes in search of higher yields.

Another significant challenge is the increasing complexity of global markets and regulatory environments. Family offices must navigate a maze of legal, tax, and compliance issues across multiple jurisdictions, often requiring specialized expertise and resources. This complexity underscores the importance of building strong relationships with trusted advisors and service providers who can provide guidance and support in these areas.

Despite these challenges, family offices are well-positioned to capitalize on unique investment opportunities. Their long-term investment horizon and flexible capital structure allow them to pursue strategies that may be impractical for other types of investors. For example, family offices can invest in illiquid assets or early-stage companies with the patience to wait for long-term value creation.

Comments