Hong Kong, March 25, 2024

With Bitcoin reaching all-time highs and a total market capitalisation of over $2.37 trillion, the cryptocurrency sector is growing quickly. The MiCA rule will go into effect on June 30, 2024, and other regulations, intended to increase confidence and transparency and encourage broader use of cryptocurrencies, will follow on December 30, 2024.

Brokers are eager to capitalise on this rising demand, and in response, B2Broker announces the release of B2Trader Brokerage Platform (BBP), a crypto spot broker solution that accelerates the process of entering the crypto market and making the most out of the growing trends.

Who Can Benefit From B2Trader

B2Trader serves a range of organisations, and here’s how each can utilise it.

FOREX Brokers

B2Trader can be an excellent addition to any FX broker. Along with the traditional trading platforms (MT4, MT5, cTrader, etc.) that mainly handle assets like FX, crypto, equity indices, and precious metals for margin trading or in the form of CFDs, you can add B2Trader to offer crypto spot trading exclusively, attract a new segment of crypto traders interested in physical delivery or ownership, and generate revenue through commissions, markups, and effective risk management.

Additionally, BBP offers a solution for regulated FX brokers to separate their digital asset trading under a different license, promoting strategic diversification and maintaining a competitive advantage in today’s market.

Crypto Brokers

Brokers focusing on crypto CFDs, using crypto as collateral, and offering a mix of FX and crypto CFDs can use B2Trader to enhance existing solutions with crypto spot trading.

Given the competitive nature of client retention and acquisition, the absence of crypto spot trading options could lead clients to seek services elsewhere. Thus, integrating B2Trader is a strategic advantage for brokerages, allowing them to adapt to market trends swiftly, offer much-demanded crypto spot trading, and meet client expectations.

Market Makers

Market makers can use B2Trader to access multiple exchanges, consolidate liquidity efficiently, achieve competitive spreads, optimise pricing, and enable smart routing execution across different venues.

Liquidity Providers

Adding cryptocurrencies to your asset offerings greatly boosts your appeal to brokers, hedge funds and professional traders. B2Trader streamlines this process, equipping you with the essential tools to expand your market reach and accelerate your earnings.

EMIs, Payment Systems, and Banks

For EMIs, PSPs, and banks, B2Trader provides a strategic edge by enabling diverse asset management, monitoring, and liquidity pool creation. It allows these entities to add crypto services to their existing operations, net all transactions, offer crypto accounts, and enable instant swaps.

BBP provides an extensive API, easy integration with any business model, and the necessary components to access cryptocurrency trends efficiently.

Technologically Advanced, Fast, and Effective

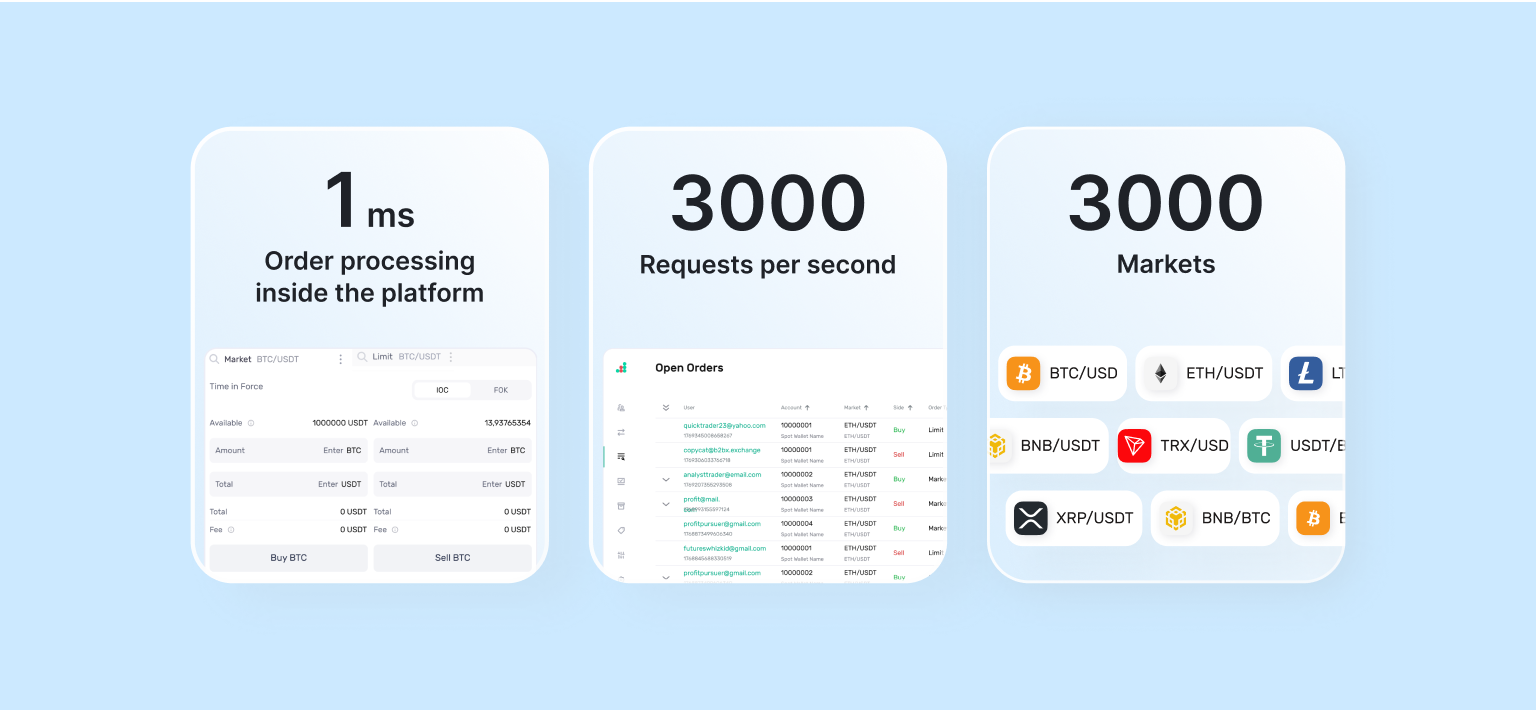

B2Trader serves brokers at the enterprise level, managing up to 3000 requests per second and 3000 trading instruments. It offers ultra-fast order execution beginning at 1 ms, real-time market data, updates every 100 ms, and possible improvements through improved cloud resources.

“Today, B2Broker is a leading name in the FinTech industry. We began operating in the FOREX industry in 2014 and have been developing solutions for the crypto industry since 2017. B2Broker has earned multiple awards and recognitions, and our years of experience have allowed us to understand what the market needs exactly.

That’s why we created B2Trader. It’s our answer to the changing trends in finance. We have poured 18 months of hard work and over $5 million into B2Trader. BBP is built by our dedicated in-house team of 40 engineers, each contributing to a solution that truly meets the demands of today’s brokers. In the next 12 months, we are planning to double the team and enhance our offerings even further!”

— Arthur Azizov, CEO and Founder of B2Broker

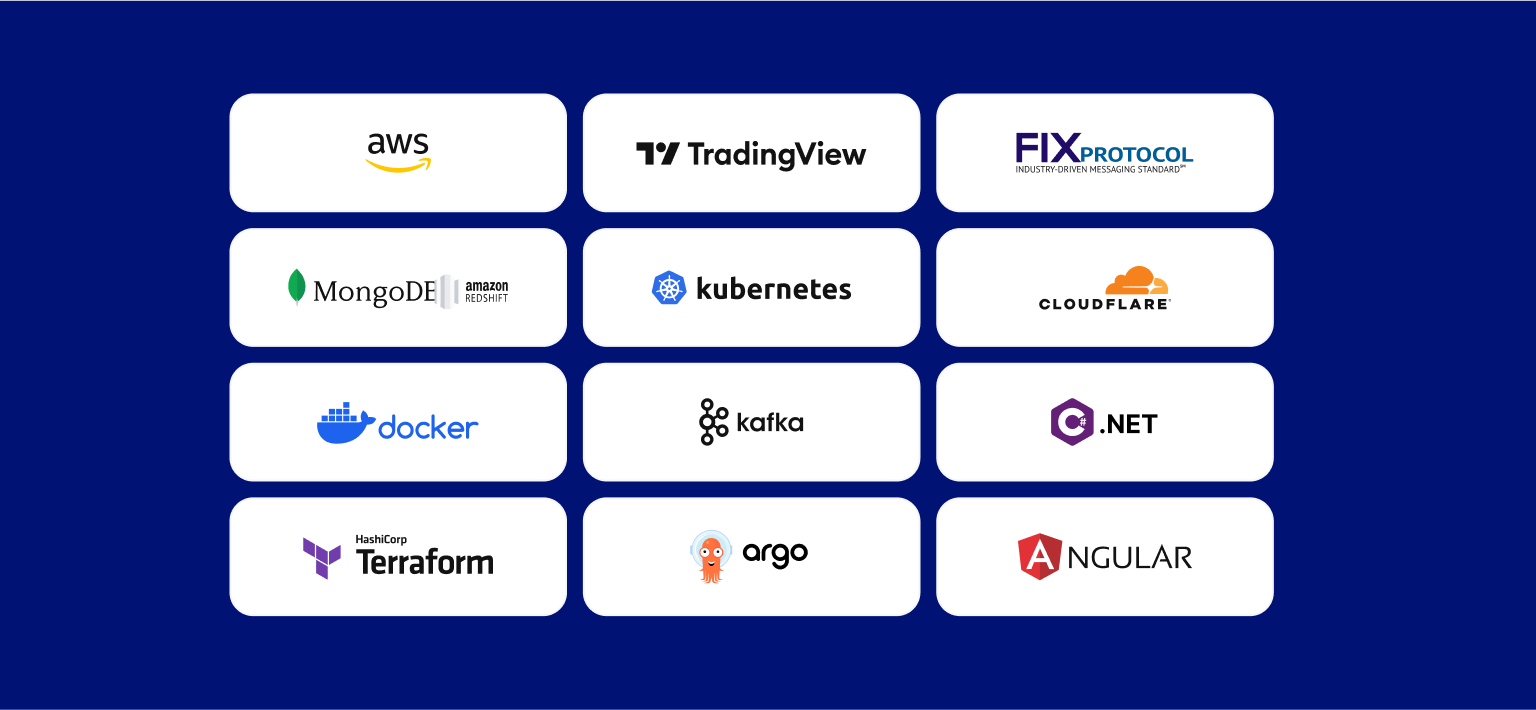

B2Trader uses state-of-the-art technology and places a high priority on security, scalability, and dependability. Reliable infrastructure is provided by AWS. It uses CloudFlare for DDoS protection, Kubernetes and Docker for scalable deployments, TradingView for market insights, and MongoDB and Amazon Redshift for data management. Reliability and efficiency are increased with the FIX protocol.

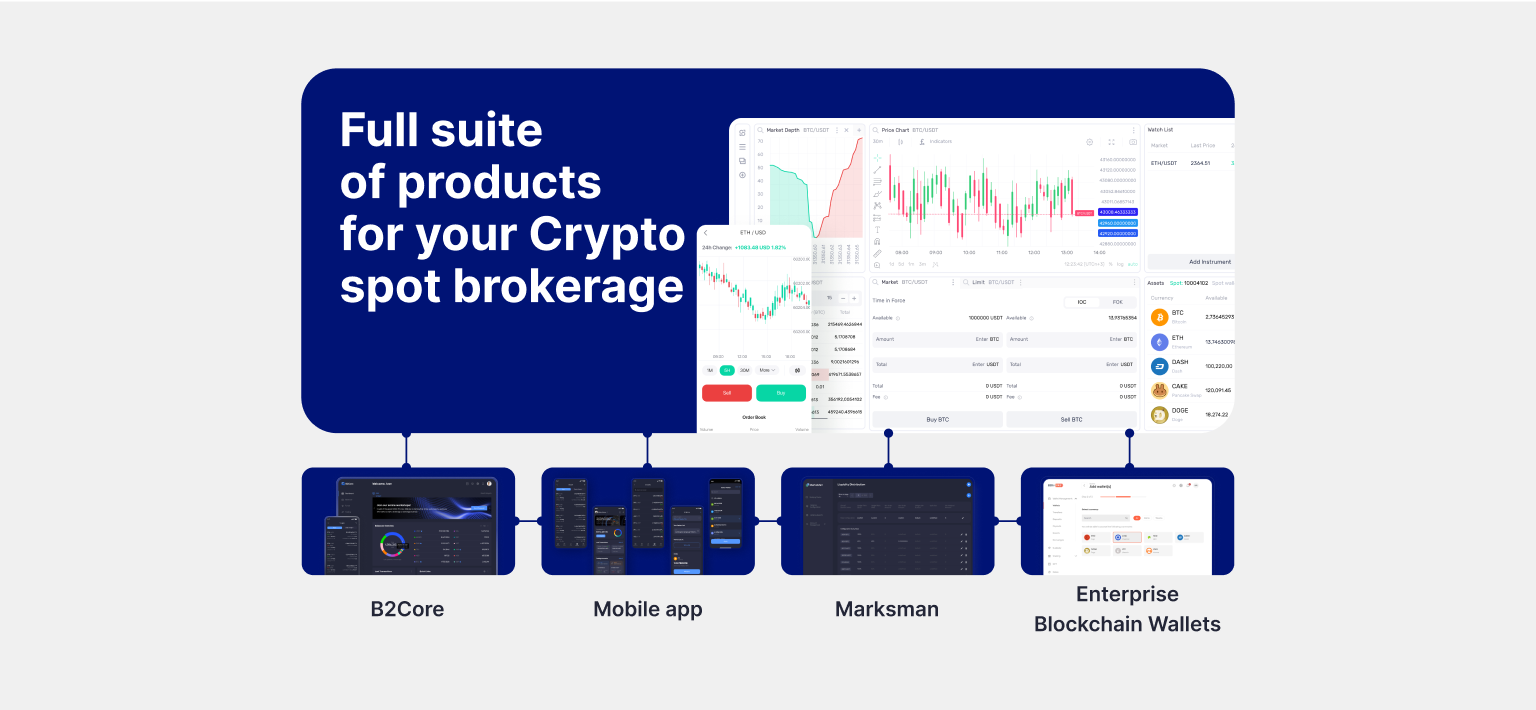

B2Trader provides strong integrations and also includes a full range of products from B2Broker, blockchain wallets, CRM, back office, mobile apps, REST and FIX API protocols, and sophisticated White Label choices. B2Trader’s integration with Marksman, a cryptocurrency liquidity distribution engine, enables quick connections to leading exchanges, allowing brokers to set up failover protocols, assign execution rules, and construct different types of liquidity pools.

Furthermore, B2Trader guarantees market updates with the most recent data and simplifies administration through its integration with Marksman, a cryptocurrency liquidity distribution engine.

After creating an account, cryptocurrency brokers can quickly connect to the most reliable exchanges by entering their API credentials into Marksman. This allows brokers to design unique liquidity pools from different exchanges, designate particular execution and routing rules, and set up failover procedures for the liquidity pools and pairings.

B2Trader may be integrated with any CRM via REST API or acquired as a turnkey solution. Reach out to the sales team or your account manager, test the demo, and launch your crypto spot broker in only a week!

Contacts:

+44 208 068 8636

Information contained on this page is provided by an independent third-party content provider. Binary News Network and this Site make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact [email protected]

Comments