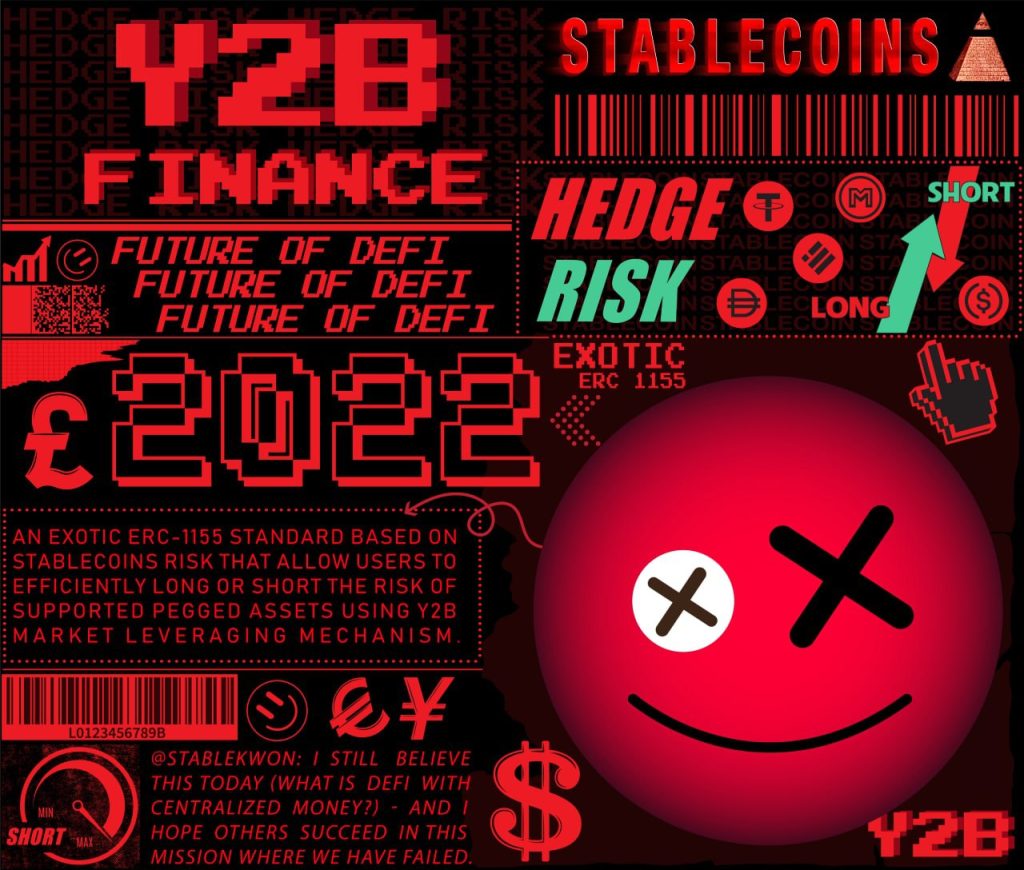

Singapore, Dec 20, 2022, ZEXPRWIRE, Y2B Finance is a suite of structured products designed for exotic peg derivatives that will allow market participants the ability to robustly hedge or speculate on the risk of a particular pegged asset (or basket of pegged assets), deviating from their ‘fair implied market value’.

Introducing Y2B Finance

Y2B Finance is the hard fork from Y2K Finance, they follow the exact same protocol from what Y2K team did. It is a suite of products designed for exotic peg derivatives that will allow participants to hedge or speculate on the risk of a particular pegged asset (or basket of pegged assets), deviating from their ‘fair implied market value’.

The protocol brings three main products to the table:

Typhoon

This flagship Y2B structured product leverages a variant of the ERC-1155 standard for the creation of fully-collateralized insurance vaults. Users can use these vaults to hedge, speculate and underwrite the volatility risk associated with various pegged assets. Token holders are rewarded from trading fees derived from this marketplace.

Users can hedge against these assets de-pegging by depositing ETH collateral into the Hedge vault and receiving Y2B tokens (Vault Tokens) in return.

Initially, users can hedge against USDT, USDC, BUSD and DAI de-pegging with weekly and monthly time periods. More assets will be supported in the future.

Volcano

Volcano is a Collateralized Debt Obligation (CDO) powered lending market for pegged assets with MEV-proof liquidations. Volcano is the secondary market place that builds on top of Typhoon tokenized vaults. Since collateral is locked up for the duration of the vault cycle, this secondary market allows users to enter and exit positions in real time via its order book.

Wildlife

Wildlife is an on-chain RFQ orderbook where users can trade Y2B risk tokens amongst themselves, both unlocking ample liquidity and allowing for rapid repricing of semi-fungible tokens.

In other words, Y2B Finance offers a fully transparent, on-chain insurance solution for users, DAOs, and more looking to hedge against their pegged asset positions. Y2B also further promotes decentralization by making these markets accessible for all participants and by providing instant and guaranteed payouts via Chainlink oracles.

Y2B brings a new set of tools to DeFi that will allow users to better manage their stablecoin risk.

To keep up with Y2B follow them on Twitter.

Official Website: https://y2b.finance/

Discord: https://discord.com/invite/uE3XgpYNJA

Official Docs: https://docs.y2b.finance/y2b-docs/

Media Contact:

Zheng Sie

Y2B Finance

[email protected]

The Post Y2B introduce protocol to allow users hedge, leverage, speculate and trade the different components of pegged assets appeared first on ZEX PR WIRE

Comments